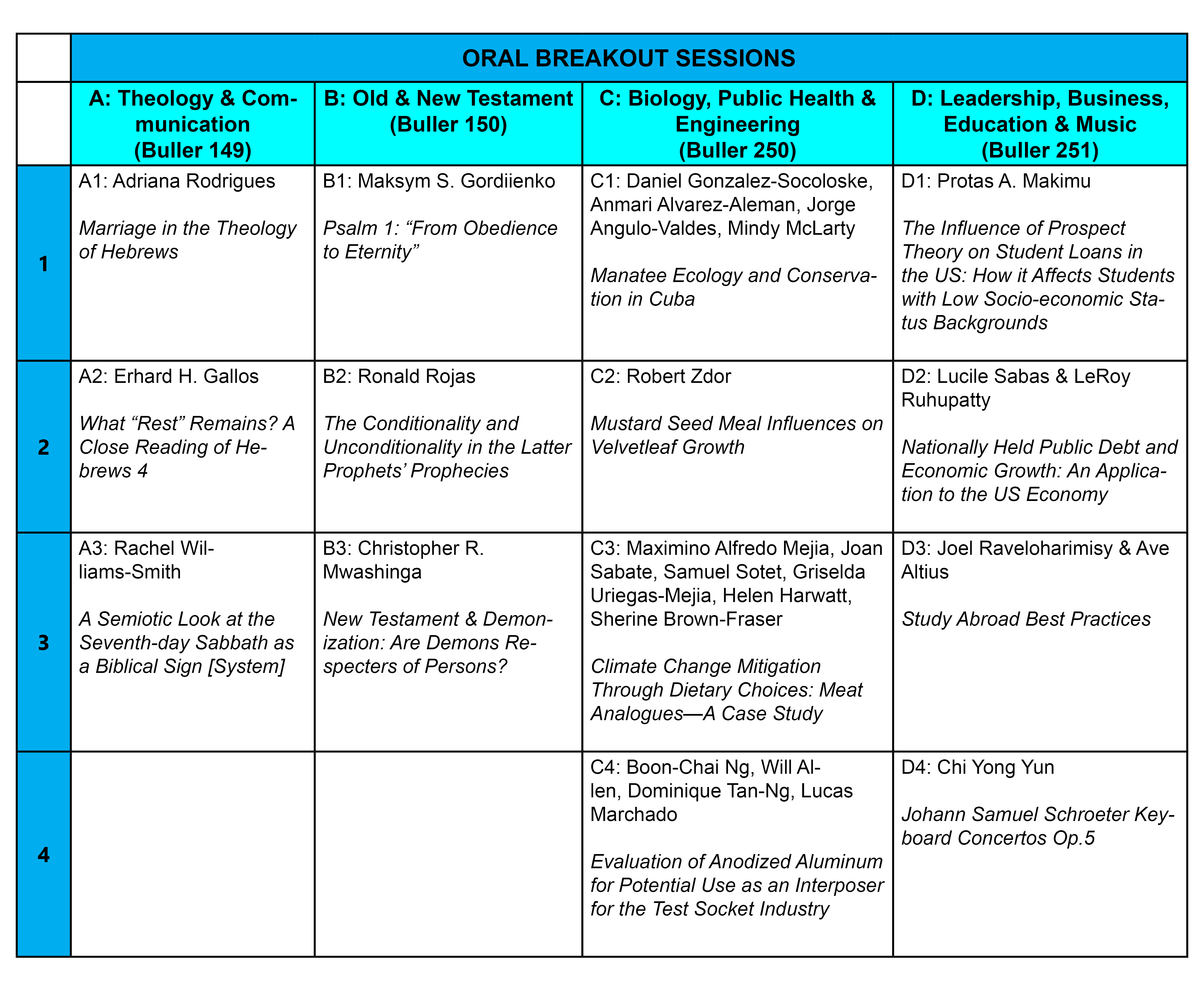

Oral Breakout Sessions

Presenter Status

Associate Professor, Department of Accounting, Economics & Finance

Second Presenter Status

Assistant Professor, Department of Accounting, Economics & Finance

Preferred Session

Oral Session

Start Date

30-10-2015 3:15 PM

End Date

30-10-2015 3:30 PM

Presentation Abstract

This paper explores the impact of nationally held public debt and foreign debt on the US economy. It has tried to define the nationally held public debt as an additional asset for the private sector by insuring a source of future saving, an increase in investment capacity and a source of increase in demand. A linear regression analysis of 39 observations from 1970 to 2014, using different lengths of lag, from one to five years have shown that for the first year, nationally held public debt has a positive and statistically significant impact on economic growth. However, the coefficient is not economically strong, showing an impact of only 0.36% of increase in US growth, resulting from a 1% increase in public debt. This result, however, is stronger than the outcome of the US public debt held by foreign investors. Furthermore, the results for the following years, though, helping to solve the correlation issue of the residuals, show very little economic impacts. The causality of the relation is also undetermined, the signs of the coefficients being different from one regression to another, and from one year to the next.

D-2 Nationally Held Public Debt and Economic Growth: An Application to the US Economy

This paper explores the impact of nationally held public debt and foreign debt on the US economy. It has tried to define the nationally held public debt as an additional asset for the private sector by insuring a source of future saving, an increase in investment capacity and a source of increase in demand. A linear regression analysis of 39 observations from 1970 to 2014, using different lengths of lag, from one to five years have shown that for the first year, nationally held public debt has a positive and statistically significant impact on economic growth. However, the coefficient is not economically strong, showing an impact of only 0.36% of increase in US growth, resulting from a 1% increase in public debt. This result, however, is stronger than the outcome of the US public debt held by foreign investors. Furthermore, the results for the following years, though, helping to solve the correlation issue of the residuals, show very little economic impacts. The causality of the relation is also undetermined, the signs of the coefficients being different from one regression to another, and from one year to the next.

Acknowledgments

This project was funded by a Faculty Research Grant.